Print #Investimentos+Simples & Aposentadoria Antecipada tweets

@ArthurVallePhD

#SPIVA Europe (S&P Europe 350 index) has just been released 83.02% of funds underperformed the index in the last 12 months 93.38% in the last 3 years 5 years? 90.20% 10 years? 92.31% underperformed Active managers struggle to beat the benchmark in Europe too Let's see Brazil soon

@ArthurVallePhD

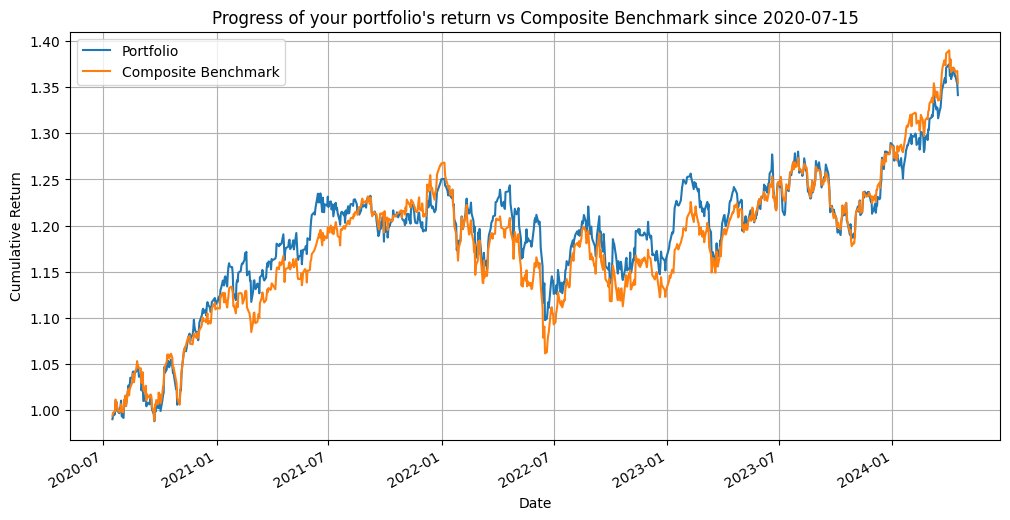

it's so good when your passive #portfolio (in blue) follows the (composed) benchmark (in orange) you have chosen isn't it? how about yours?

@ArthurVallePhD

x + y + y + y = 1; a=400,000; b=2,900,000 x*b + y*b + y*b + y*b = 2900000 1*a + x*b = 825000 what are the values of x and y?

@ArthurVallePhD

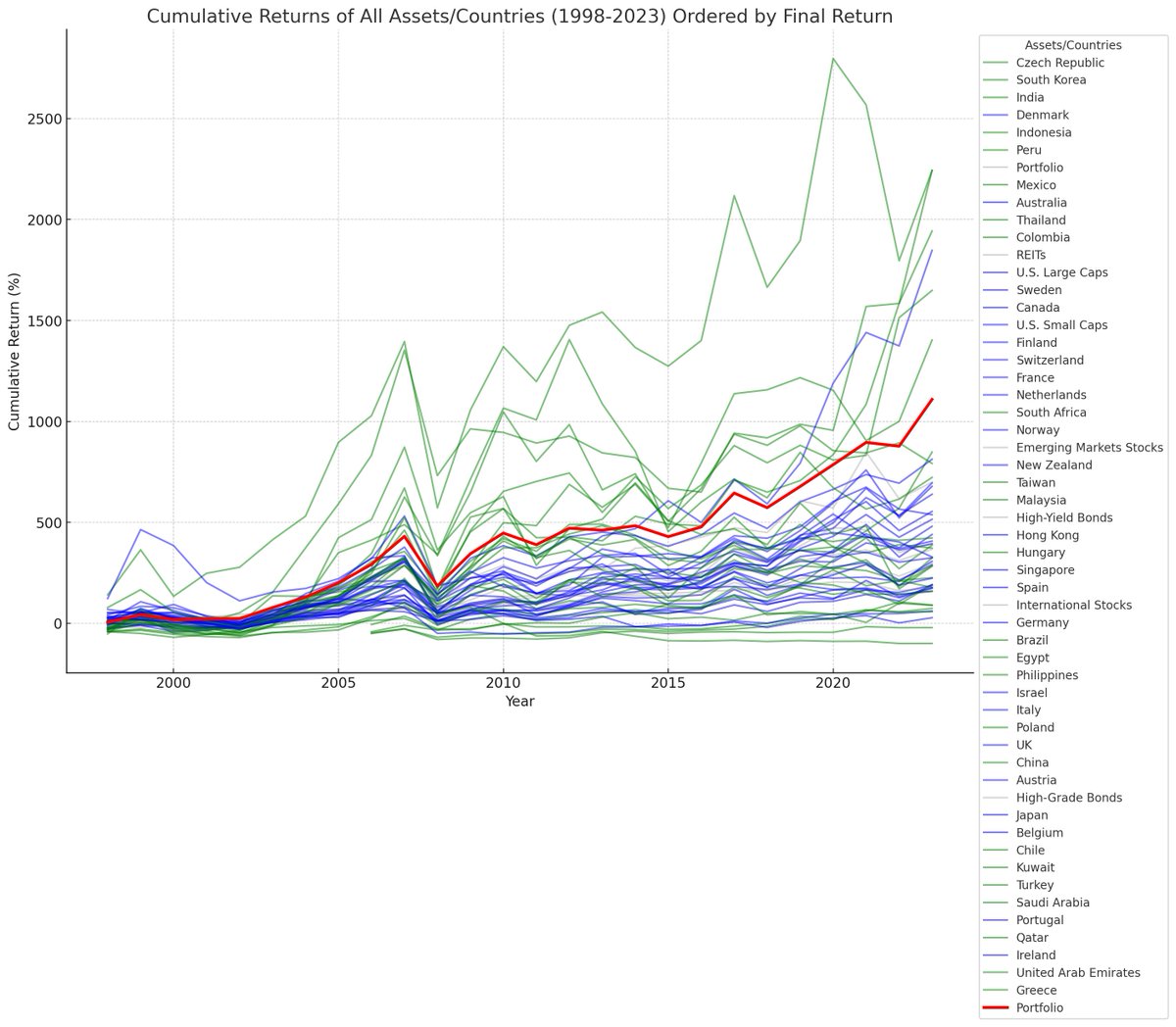

📊 Analizei retorno de diferentes países/classes 1998-2023, incluindo mercados desenvolvidos e emergentes Gráfico final mostra o desempenho de cada país e da #carteira equal-weight, com legenda ordenada pelos retornos finais #Investimentos diversificados e globais vencem sempre

@ArthurVallePhD

Tem algo mais chato que daily/stand-up meeting?

@ArthurVallePhD

Sejamos sinceros: tirando COMIDA, não há nada na NZ que seja pior que no BR

@ArthurVallePhD

Imagina não votar no Bozo porque ele FALAVA muita m@rda E eleger o Lule, que FAZ muita m@rda Brasil, o país do dólar futuro !

@ArthurVallePhD

Esqueça a Disney: o Pateta somos nós

@ArthurVallePhD

Isso aqui envelheceu rápido demais! #perfecttiming PS: sério que você ainda não me segue?

@ArthurVallePhD

Surpreendente https://t.co/pVvdtD8R2o

@ArthurVallePhD

Could you take a minute to learn how to invest passively? https://www.videoask.com/fv1019eg0 You'd really love it.

@ArthurVallePhD

Diversification matters! Top 10 NZ-issued #ETFs ranked by Sharpe ratio: USV-US Large Value 3.35 MZY-Australian Mid Cap 3.11 EUG-Europe ESG 2.63 OZY-Australian Top 20 2.66 TWF-Total World 2.17 USF-US 500 2.16 EUF-Europe 2.48 ESG-Global ESG 1.67 JPN-Japan ESG 1.75 USA-US ESG 1.69